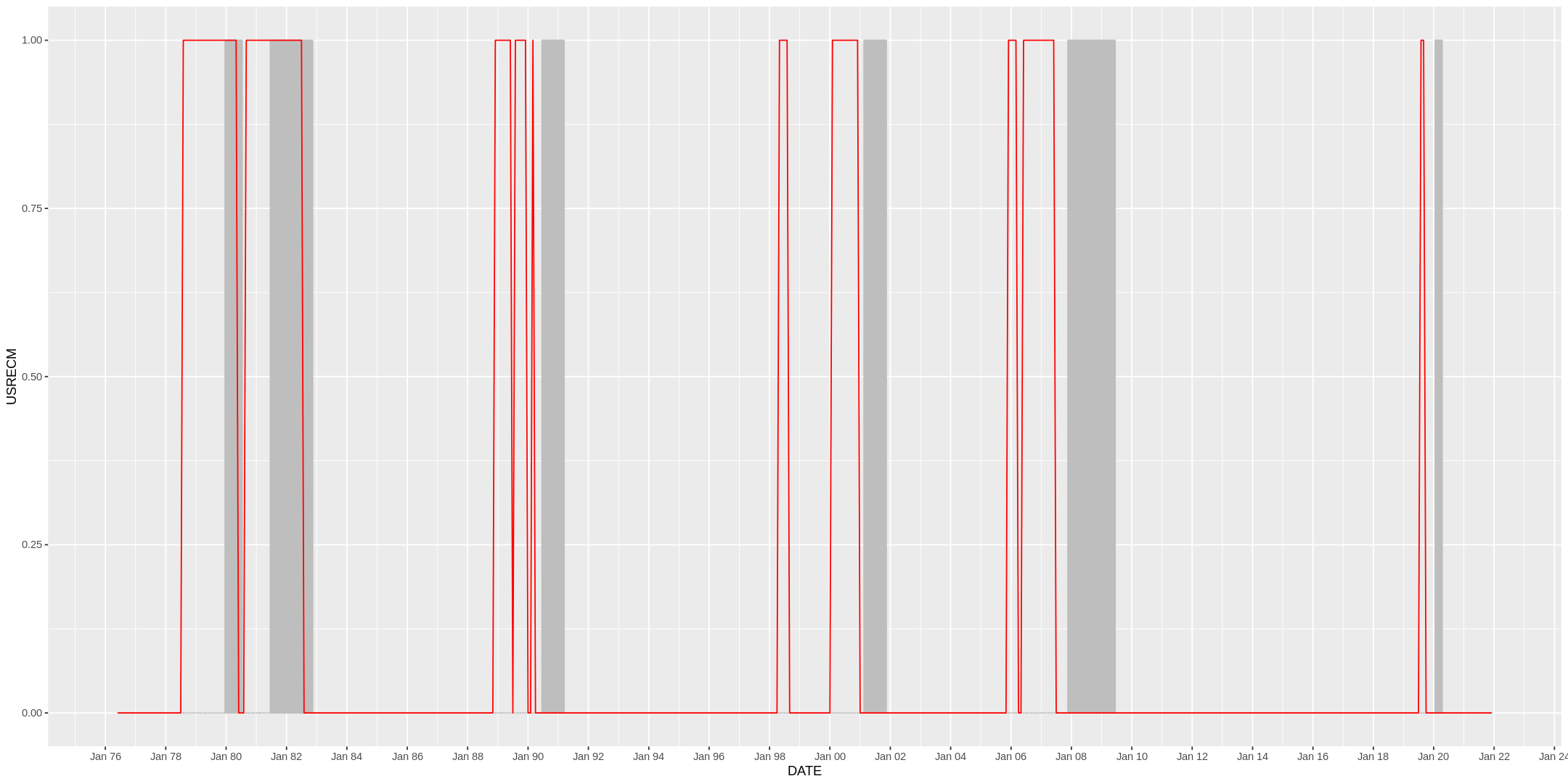

Whether the recession of 2020 was caused by changing macroeconomic conditions or as an unintended consequence of deliberate government action, a popular leading indicator of downturns in economic activity signaled a recession in the U.S. economy within its range of influence of 18 months. A yield curve inversion, that is, a negative differential between the 10-year treasury note and the 2-year treasury note, occurred in April 2019, roughly 11 months before the official start of the Covid-19 recession, increasing the record of true positives for this indicator to 90 percent over the last 50 years.

In this Google Colab Notebook, I show a simple classification model using the C5.0 and the random forest algorithms with monthly data on recessions and yield-curve inversions. This model uses data from 1975 to 2022.